Business expenses: What counts as an expense and how to categorise them

At some point every entrepreneur ends up staring at a receipt and asking the same question: Can I put this under the company or not? A new laptop, Google advertising, lunch with a client, phone bills, conference tickets. Some of it feels obviously business-related. Some of it feels… grey.

The tricky part is that this decision is not just about bookkeeping. It affects your taxes, your cash flow and how your company looks in the annual report. So it is worth understanding the logic behind it. Let’s break it down.

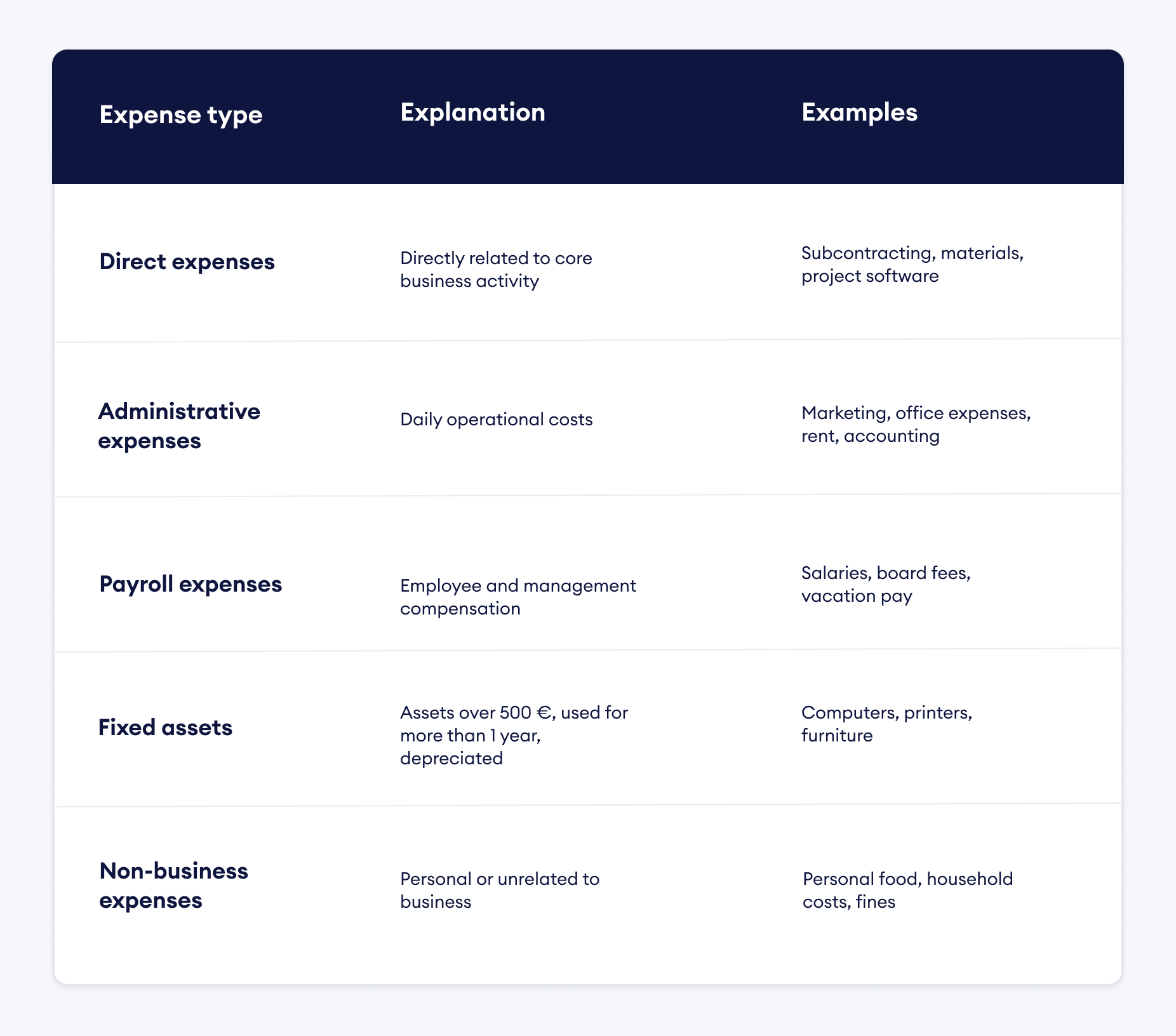

Direct expenses

Direct expenses are the easiest to understand. These are the costs without which you simply could not provide your service or product. If these expenses disappeared, your business would stop functioning.

Examples:

subcontracted services

materials purchased for a project

software licenses used for your work

A simple way to test this: Ask yourself whether you could still sell your service or product without this expense. If the answer is no, then it is a direct expense.

Administrative expenses

Administrative expenses are less visible but just as important. They do not belong to any specific client or project, yet they quietly keep your business running. Without them, growth and daily operations become almost impossible.

Examples:

marketing expenses such as Google Ads, trade fairs, printed materials

work environment costs such as office internet and office supplies

rent for office or storage space

work equipment such as computers, desks and chairs

insurance

accounting and legal services

trainings and conferences

business trip expenses such as flights and accommodation

Many founders underestimate this category, especially recurring costs. Internet, mobile phone, subscriptions, utilities. They are often paid from a personal account because the contracts were signed before the company existed. Over time these “small” costs become a large part of the company’s real spending. They belong in your business expenses and, if possible, should eventually be moved under the company’s name.

Non-business expenses

This category is less pleasant but very important. If an expense has no direct connection to your business activity, it cannot be treated as a company expense. It must be taxed.

Examples:

personal food and household expenses

trainings unrelated to work, such as hobby courses

fines and tax interest

Trying to hide personal life inside the company books almost always creates problems later.

Restaurant expenses

This is one of the most confusing areas for founders. If you meet a client or business partner, their food and drinks may be recorded as representation expenses. In Estonia the limit is 50 € per month plus 2% of the payroll, calculated cumulatively over the calendar year. Your own portion of the meal, if you are an employee or a board member, is always a fringe benefit and must be taxed. This often feels unfair at first. You sit at the same table, eat the same food, talk about the same business, yet only the client’s meal is treated as a business expense.

The simplest solution:

Pay the client’s part with the company card and your own part personally.

It may not feel logical, but it keeps your accounting clean and avoids fringe benefit taxation.

Payroll expenses

Payroll expenses are connected to people working in your company and the taxes that come with their compensation.

Examples:

salaries and payroll taxes

board member fees

vacation pay

sickness benefits

These costs usually form one of the largest parts of a growing company’s budget, which is why tracking them clearly matters.

Fixed assets

Some purchases are too large and too long-lasting to be treated as ordinary expenses. If something will be used for more than one year, you may record it as a fixed asset. Each company can decide its own threshold. Most companies use around 500 €, but it can be lower or higher. The idea behind fixed assets is simple. Instead of showing a huge expense all at once and making the company look unprofitable, the cost is spread over several years. This spreading is called depreciation.

Examples of fixed assets:

computers

mobile phones

printers

office furniture

purchased software

Example:

If you buy a computer for 1,200 €, it is rarely sensible to record the entire amount as an expense immediately. That computer will serve your business for years. So you spread the cost over 3 to 4 years and the financial picture stays realistic.

Practical situations

Car usage

If you use your personal car for work, you may pay compensation up to 0.50 € per kilometer, with a monthly maximum of 550 €. You must keep a driving log and report the data once a year to the Estonian Tax and Customs Board.

Advertising

A Google campaign or a trade fair booth is a business expense. A birthday cake is not.

Recurring costs

Phone, internet, utilities. They are often “invisible”, yet they quietly eat a large part of your budget.

Business trips

Accommodation, transport tickets and parking fees are reimbursable based on proper expense documents.

Common mistakes

Ignoring representation expense limits

Client meetings, partner dinners and business events are business-related, but only up to a certain limit. Any amount above the limit must be taxed, which is why careful tracking matters.

Using the company card as a personal card

This is one of the most common mistakes. If you accidentally pay a personal expense with the company card, transfer the same amount from your personal account back to the company. If you do not, the expense becomes taxable.

Recording fixed assets as immediate expenses

Large, long-lasting purchases should be depreciated, not recorded at once. Otherwise your company can look unprofitable on paper for no real reason.

Not keeping documents

Invoices must be stored for at least 7 years. A bank statement alone is not enough.

Ignoring company formation costs

State fees and notary fees are often paid before the company exists, so they are forgotten. They are still business costs and should be reimbursed to the owner.

Summary

Correct expense categorization is not just an accounting formality.It is one of the foundations of healthy taxation and financial clarity.

The rule is simple: If the expense serves the company’s purpose, it belongs to the company. If it does not, it is personal and must be taxed. When your categories are clean, your numbers make sense and your business becomes much easier to manage.

FAQ

Do business lunches count as company expenses?

The client’s portion can be recorded as representation expense within the legal limit. Your own portion is always a taxable fringe benefit. The easiest solution is to pay separately.

Can I put my personal car expenses under the company?

No. You may only pay kilometer compensation of up to 0.50 € per kilometer, with a monthly limit of 550 €, if you keep a driving log.

What if I accidentally buy something personal with the company card?

Transfer the same amount back from your personal account to the company. This prevents additional taxation.

Does a computer over 500 € go directly into expenses?

No. If it is used for more than one year, it should be recorded as a fixed asset and depreciated over time.

Start your company's annual report here!

- Easy-to-use web solution to create annual reports yourself

- Ability to generate a report for a specific period

- Simple and thoroughly instructed process

- Trusted partner of Estonian Business Registry

- Only you own your data

| Pricing |  49€ 49€

|

|---|---|

| Micro-enterprise annual report | |

| All necessary instructions | |

| Customer Support | |

| 30 day money-back guarantee | |

| Investments | |

| Fixed assets | |

| Owner transactions | |

| Salaries | |

| Dividends | |

| VAT | |

| The price includes report preparation for one reporting period. | |