Company Car or Personal Car Compensation. Which Option Is Better?

Every entrepreneur eventually reaches a moment where they need a car for work tasks. Then the practical question appears: should the car be registered under the company, or should you receive compensation for using your personal car? The answer depends on how much you drive and what kind of trips you make.

Personal Car Compensation

You can receive compensation for using a car that does not belong to the company. It does not have to be owned by you, but you must have the right to use it, for example a lease contract or a written permission from a family member.

The driving records are the key

Tax-free compensation can only be paid if proper driving records are kept for all work-related trips.

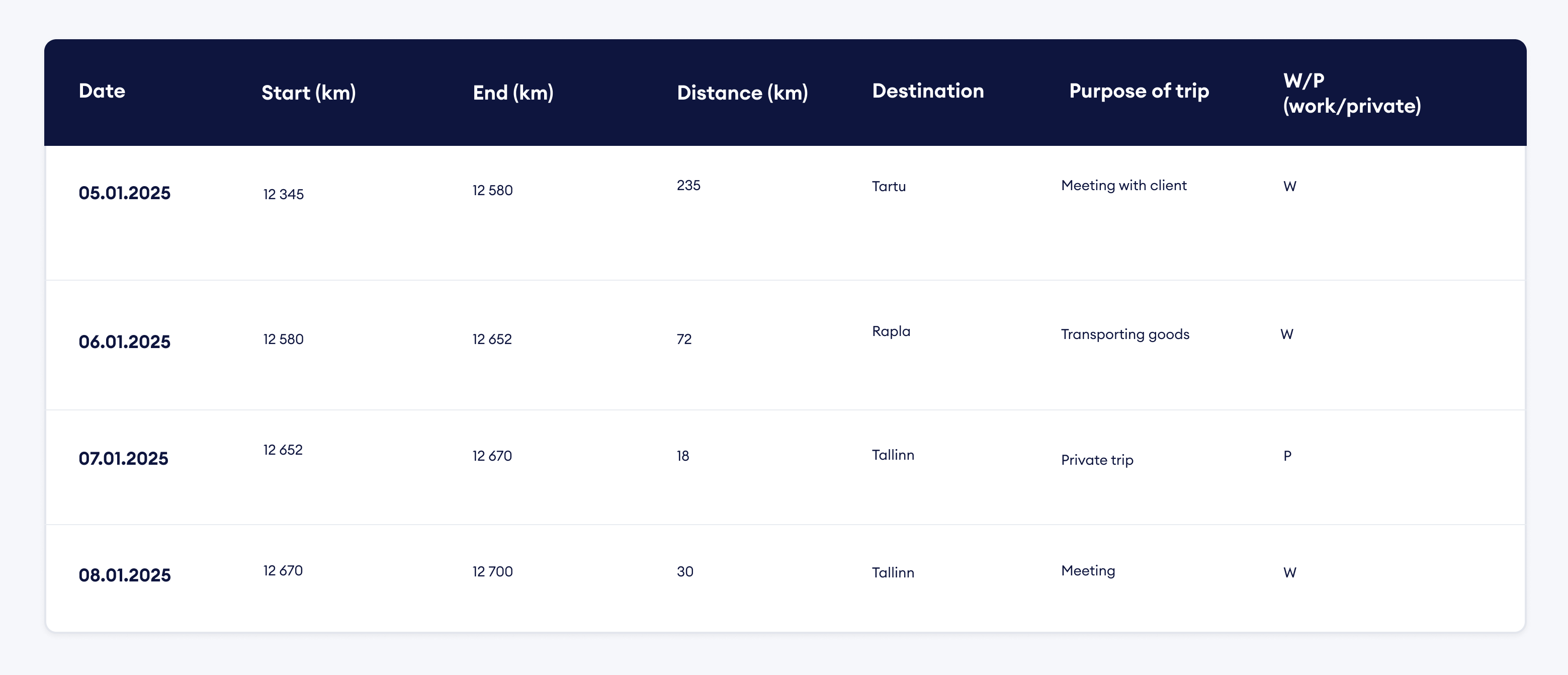

Driving records example

General information

Vehicle registration number: 123ABC

Car make and model: Toyota Corolla

Period: January 2025

Odometer reading at the start of the month: 12 345 km

Driving records kept by: Ann Mets

Company: OÜ Example

Monthly summary

Odometer at end of month: 12 700 km

Total distance driven: 355 km

Work trips: 337 km

Private trips: 18 km

What costs are included?

The compensation already includes all normal car costs, such as fuel, insurance, maintenance and tyres. You cannot add these as separate company expenses.

💡Practical tip

If you accidentally pay for private fuel or another private car expense using the company card, transfer the same amount from your personal account back to the company account.

This way the company will not have a cost and no tax obligation appears.

If you do not return the money, the expense is treated as a fringe benefit and you must pay income tax and social tax on it. This must be declared in TSD Annex 4.

Commuting between home and work

Some trips between home and the workplace can count as work trips. This applies when public transport is not reasonable on that route or when the employee lives at least 50 km from the workplace (Income Tax Act § 48 (51)).

If driving records are not kept

Be aware that if compensation is paid without driving records, it is treated as salary and all normal salary taxes must be paid (TSD Annex 1).

Company Car

If the car is registered under the company, the tax rules depend on whether private trips are allowed or not.

Only work trips allowed

If the car is used only for work, there is no fringe benefit tax.

The company must notify the Transport Administration that private trips with this car are not allowed.

VAT: The company can deduct 100 percent of the VAT from the car purchase and all running costs, including fuel and maintenance.

Keeping driving records is not mandatory, but having them (or using a GPS solution) can help if you ever need to prove that the car is used only for work.

👉 Example: You buy a car for 20 000 € + VAT (24%) = 24 800 €. If it is used only for work, you can deduct all VAT (4 800 €). The real cost for the company is 20 000 €.

If private trips are allowed

A fringe benefit is created and its value depends on the engine power:

New car: 1.96 € per kW per month

Older than 5 years: 1.47 € per kW per month

VAT: Only 50 percent of VAT on the purchase and running costs can be deducted.

You must pay income tax (using the 22/78 method) and social tax (33 percent) on the fringe benefit. It must be declared monthly on TSD Annex 4 (code 4040). This is a monthly cost as long as private trips are allowed.

👉 Example: Same car 20 000 € + VAT (24%) = 24 800 €. If private trips are allowed, you can deduct only half of the VAT (2 400 €). The real cost is 22 400 € plus the monthly fringe benefit tax, depending on engine power.

Examples

New 190 kW car. Fringe benefit value: 372.40 €

Income tax: 105.04 €

Social tax: 157.56 €

Total taxes: 262.60 € per month

New 90 kW car. Fringe benefit value: 176.40 €

Income tax: 49.75 €

Social tax: 74.63 €

Total taxes: 124.38 € per month

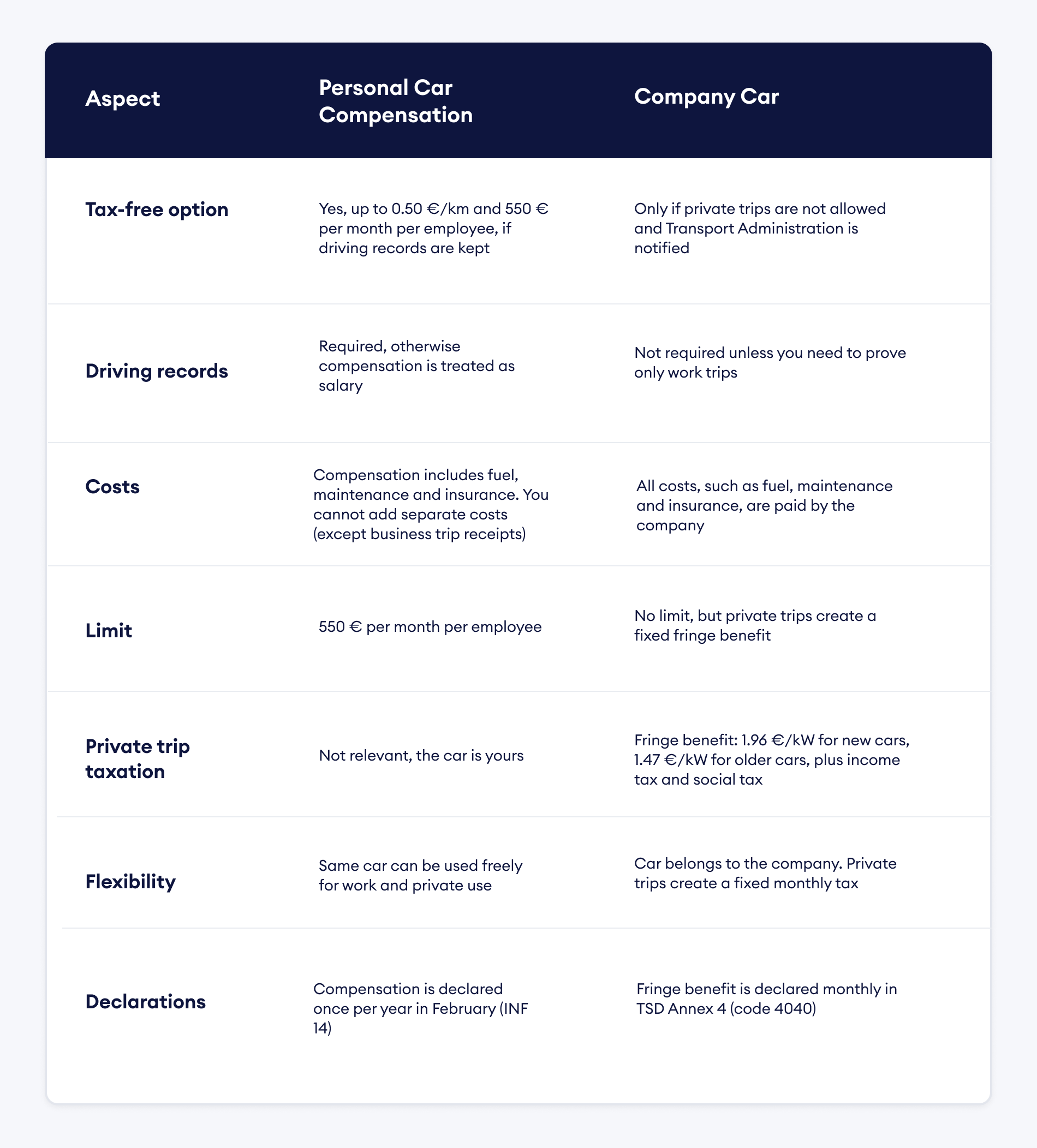

Comparison: Personal Car Compensation vs Company Car

Summary

There is no single correct answer.

If you drive only a little for work and want to use the same car for both work and private life, personal car compensation is the simpler and cheaper option.

If the car is an important daily work tool and you drive a lot, a company car may be more reasonable, especially if private trips are not allowed.

The most important thing is to follow the rules and keep your driving records accurate. This helps you avoid unpleasant tax surprises later.

Start your company's annual report here!

- Easy-to-use web solution to create annual reports yourself

- Simple and thoroughly instructed process

- Trusted partner of Estonian Business Registry

- Only you own your data

| Pricing |  49€ 49€

|  69€ 69€

|

|---|---|---|

| Micro-enterprise annual report | ||

| All necessary instructions | ||

| Customer Support | ||

| 30 day money-back guarantee | ||

| Investments | ||

| Fixed assets | ||

| Owner transactions | ||

| Salaries | ||

| Dividends | ||

| VAT | ||

| NB! You can choose your package after company search. | ||