OÜ or Entrepreneur Account. How to Choose?

When you want to start offering your service, or you already have a ready-to-purchase client, the first question comes quickly: which business form should you choose? Maybe you have heard about the Entrepreneur Account and wonder if it is easier than starting an OÜ. Or maybe your friends recommend an OÜ as the most reasonable option, even if it feels a bit more complicated.

The truth is simple. Both options are good. They are simply meant for different situations. Let’s take a closer look to see which one suits you best.

Entrepreneur Account. The easiest choice if you work with private individuals

An Entrepreneur Account is a good option when you sell your services to private clients. For example, you provide childcare, offer cleaning services or sell handmade items. You open the account in a bank, clients pay to that account and the bank automatically calculates and deducts the entrepreneur tax.

In theory, not only private customers like your neighbour or a Facebook friend can pay you through the Entrepreneur Account, but companies can also use it to buy your service. The problem is that this option becomes more expensive for both sides. The tax is taken from your income immediately, and the company purchasing your service must also pay income tax on top of it. This makes the same work more expensive for everyone. Because of this, the Entrepreneur Account is mostly used for selling services to private individuals.

A great thing about the Entrepreneur Account is that opening it is usually free, depending on the bank’s price list. At the moment, you can open one at LHV Bank.

The main downside is that you cannot deduct any expenses. Everything that comes into the account is taxed. For example, you cannot deduct the cost of a computer, phone or training. With an OÜ, if you receive 1000 € and use it to buy a work laptop, the laptop becomes a company expense and no tax is created. With the Entrepreneur Account, if you earn the same 1000 €, the tax is taken immediately and the amount you keep is smaller.

OÜ. Flexible and suitable for both companies and private clients

An OÜ is the most common form of business in Estonia. There are hundreds of thousands of registered legal entities and the OÜ is by far the most popular. Unlike the Entrepreneur Account, an OÜ works very well for both businesses and private customers.

Also, a big advantage of having an OÜ is the ability to deduct business expenses. You can treat your laptop, phone, software or training as company costs, and even buy a new coffee machine for the office without creating extra personal expenses. You only pay corporate income tax when you take money out of the company as dividends. This gives you more freedom to reinvest and grow your business.

However, running an OÜ requires a little more administration. If your turnover is small, the only requirement is to submit the annual report once a year, and this can be done for under 50 €. When your company grows, you may need to submit more declarations, but in the beginning a small OÜ is very easy to manage.

Starting an OÜ costs 265 € in state fees in the Business Register. The minimum share capital is only 0.01 €, which is more than enough when you start.

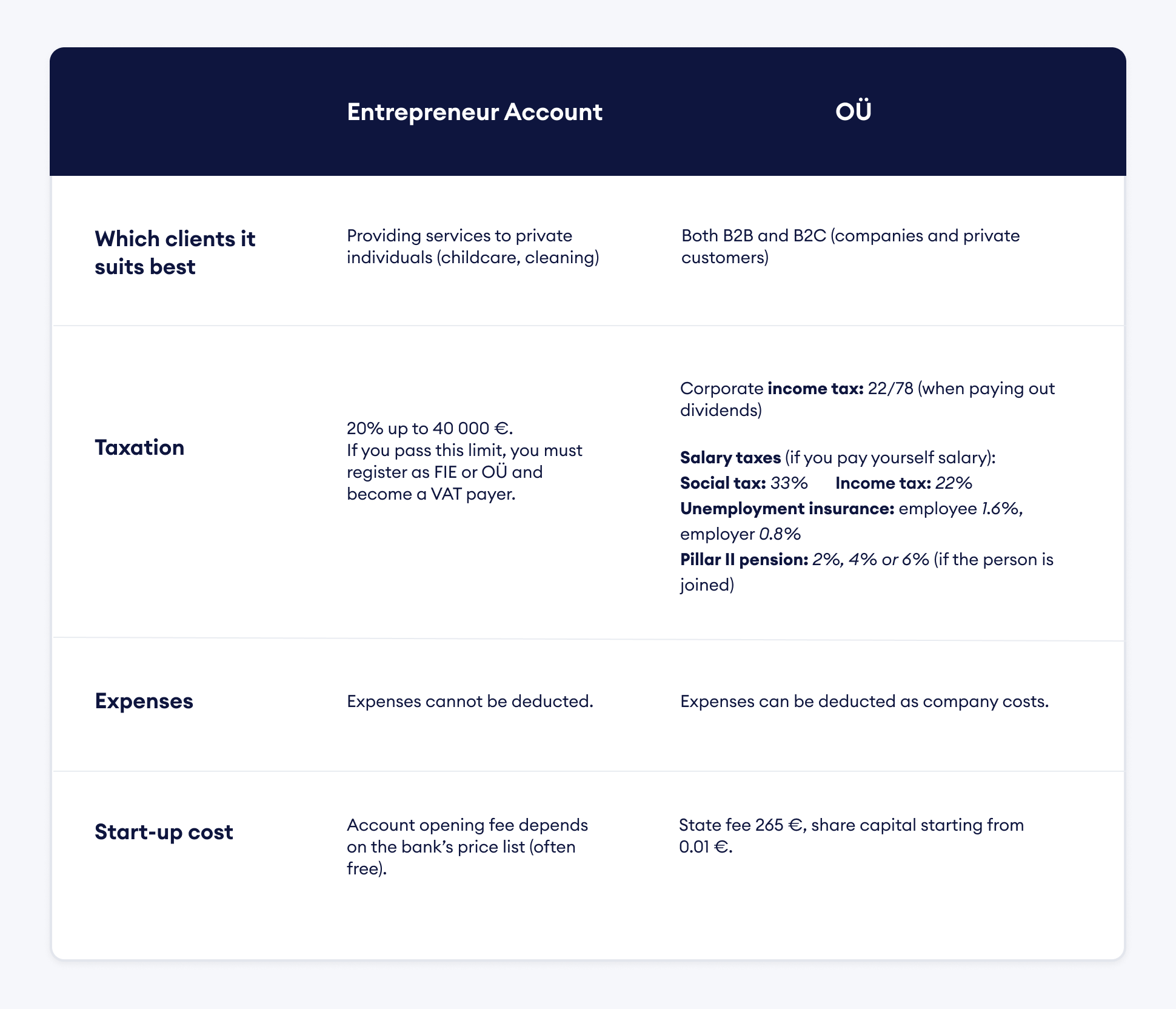

Quick comparison

Entrepreneur Account

The Entrepreneur Account works best when your clients are private individuals and your business is small. It has almost no administration, the tax is calculated automatically and opening the account is usually free. The main downside is that you cannot deduct any expenses, and everything that comes into the account is taxed.

OÜ

Compared to the Entrepreneur Account, an OÜ works very well for both businesses and private customers. You can deduct business expenses, take money out as salary or dividends and reinvest more freely. The administration is slightly higher, but in the beginning it is still very simple, especially if your turnover is small.

How to decide?

If your clients are mainly private individuals and you work in a smaller volume, the Entrepreneur Account is the easiest choice with the least bureaucracy.

If your clients are companies, you want to deduct expenses and you plan to grow your business, then an OÜ is the better option.

Summary

If you feel that the Entrepreneur Account does not meet all your needs, you can always start an OÜ later. And if you begin with an OÜ but want a simpler option for occasionally selling services to private individuals, the Entrepreneur Account can also work well. Starting a business opens new opportunities, so do not be afraid to try. Begin with the option that feels easiest for you today and move forward one step at a time.

Start your company's annual report here!

- Easy-to-use web solution to create annual reports yourself

- Simple and thoroughly instructed process

- Trusted partner of Estonian Business Registry

- Only you own your data

| Pricing |  49€ 49€

|  69€ 69€

|

|---|---|---|

| Micro-enterprise annual report | ||

| All necessary instructions | ||

| Customer Support | ||

| 30 day money-back guarantee | ||

| Investments | ||

| Fixed assets | ||

| Owner transactions | ||

| Salaries | ||

| Dividends | ||

| VAT | ||

| NB! You can choose your package after company search. | ||